Broadly there are two frameworks of labour law enactments that cover organizations. One is The Karnataka Shops and Commercial Establishments Act (S&E), which is a State legislation administered under the Department of Labour. Second, is the Factories Act 1948, central legislation which covers all manufacturing entities that employ 10 or more persons using power, where prior approval is required from a building, safety, health, pollution, power standpoint.

Request a Demo for Payroll Services

Exempt Organisations

Under the S& E Act, there are 8 types of organizations who are not covered under within the ambit of the S& E law. They are

- Government Offices – Central and State government Offices including those of local authorities are excluded.

This does not cover commercial establishments of the government. For example, Karnataka Soaps and Detergents Ltd, although owned by the State, it’s offices are expected to adhere to the S&E Act.

This does not cover commercial establishments of the government. For example, Karnataka Soaps and Detergents Ltd, although owned by the State, it’s offices are expected to adhere to the S&E Act.

2. Public Utilities such as railways, railway dining cars, water, power, public conservation, sanitation, postal, telegraph, telephone, public lighting, etc.

3. Disability Services – Organisations engaged in the treatment and care of the handicapped or mentally unfit.

4.Food Corporation of India and all it’s facilities.

5. Legal Services – Lawyers and law offices that employ not more than 3 persons.

6. Medical Services Doctors and clinics that employ not more than 3 persons.

7. Banking Services and their Offices including branches.

8. NGO’s doing a charitable activity/Non Profit Organisations.

When to register

New shops or commercial establishments in Karnataka are required to apply for Karnataka Shops and Commercial Establishment Act Registration within 30 days of commencing business.

Commencement of business is the date on which the operations commence, although the date of incorporation or formation may precede it. The determination of the commencement of business date is a matter of circumstance and the unit could be called upon to corroborate. Some of the ways to support such a determination is a date of production from production records, date of hiring from Attendance, Salary Register and similar records, Invoices, and Sales Register and may require to be further substantiated by the books of accounts and bank statements.

How to register

The registration of a new establishment has been simplified and can be done online. To access the website, one needs to click on this link

Who is the person who has to do the registration

Depending on the legal entity, be it a Proprietorship, Partnership Firm or a Limited Company, it is the Proprietor, Partner, Director or such official of the establishment who would be the responsible person expected to register the establishment with the Department of Labour. At the time of first-time registration, you are to furnish the PAN No of the establishment and your mobile number. In the sign-up process, your user name and password credentials will also be set up.

Below is a sample screenshot of the Sign-Up form

If for any reason, the user is not able to get the User Name & Password on his mobile or email due to technical glitches in the department portal, he can call the PRO section or he can visit the dept to collect the same.

The user has the option to change his password in the r the menu after logging in under– Edit Profile. After changing the password, the user should log in again to the dept portal and need to select the – Menu– Registration (Part A). Once the user selects the option Registration (Part A), the user will be prompted to select the options to fill in the application form.

After selecting the options user will be directed to fill the application form

Information to be filled in

1. Name of the Company

2. Postal Address

3. Telephone No

4. Email Address

5. Details of Director/ Managing Director/ Proprietor – Address, Phone No, email ID

6. Details of Authorized Signatory

7. Nature of Business

8.Date of Commencement of Business

9. No. of employees in the Company (Male & Female to be mentioned separately)

10. Weekly Holiday

Jurisdiction of the establishment where it is situated and concerned circle in the S&E Department. The area is based on the ward’s of the city, a town which is mapped to Circles in the Labour Department.

9 Key Documents to be furnished

Along with the online form and information filled in, the following are the supporting scanned records to be furnished.

- Incorporation Certificate

- Memorandum of Association and Articles of Association.

- List of Directors.

- Address Proof of the company

- Identity & Address Proof of the directors/ Authorised Signatory

- PAN of the company

- Child Labour Declaration affirming that the unit does not employ any children below 14 years.

- Authorization Letter to represent the establishment before the Department of Labour.

- Payment Made receipt

Registration Fees

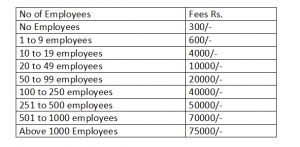

After filling up the application form, the user is required to pay the prescribed Fees. The fee structure is a slab system based on the range of the expected number of employees envisaged.

Shops & Establishment registration fees applicable from Jan 2019

Payment of the prescribed registration fee would take you to the State Government treasury called Khajane II at the following link.

Post Submission of the Application Form

Your application status can be viewed online. Online submitted documents have to be approved or to be rejected by concerned Labour Inspector within 15 working Days. After approval from the Labour inspector, a user can download the Shops & Establishment certificate online under Menu –Reports

Establishments having more than one branches

If an Establishment is having different branches in the city or in the same state they should obtain separate Shops & Establishment registration for each branch.

License Renewal

Shops & Establishment Licence is renewed once in Five Years.

Post Registration Compliances

- Annual Returns – In Form U is to be filed on or before 31st January every year. This covers information for the Calendar year Jan to December and contains information on the employees, salary data, leave data, contract employee data, etc and can be submitted online.

- Registers to be maintained -The following registers are to be maintained with updated information at all times. They are :

- Leave Register with Wages information Form–F

- Leave with Wages Book – Form H

- Combined Muster Roll cum Register of Wages – Form T

- Labour Inspectors Visit book/ Inspection Book

- Appointment order in Form –Q

- Weekly Off Notice in Form P

Display Obligations

The establishment is required to display at the reception of its facility the following abstracts so that all its employees are made aware of their rights and duties under the following labour related enactments.

- Form U– Abstract of Payment of Gratuity Act

- Form J – Abstract of Maternity Benefit act

- Form V – Abstract of the Karnataka Payment of wages act

- Form x – Abstract of Minimum wages act

6 New Central Labour law initiatives

Central Govt Ministry of Labour & Employment has taken various measures to promote ‘Ease of Doing Business’ through transformative reforms both legislative as well as governance, with extensive use of technology to provide better delivery of services to the businesses. There are 6 initiatives, which are :

- Online Registrations – Registration process for EPFO and ESIC are now fully online on a real-time basis

- Single window – Common Registration Service on the e-biz Portal of DIPP for registration 5 central laws.

- Monthly Operational Digital Compliances – Launch of Shram Suvidha Portal for A Unified Web Portal ‘Shram Suvidha Portal’ has been launched to bring transparency and accountability in the enforcement of labour laws and ease the complexity of compliance

- Annual Digital returns filing – Single Online Common Annual Return under 9 Central Labour Acts has been made operational on Shram Suvidha Portal

- Common Registers – “Ease of Compliance to maintain Registers under various Labour Laws Rules, 2017” was notified on 21st February 2017 which has in effect replaced the 56 Registers/Forms under 9 Central Labour Laws and Rules made thereunder into 5 common Registers/Forms

- Factories Act Integration – of State level compliances for Factories Act through Shram Suvidha portal. Already 9 states were on-boarded to this portal. Other states are expected to do the same shortly

Conclusion

The S & E Act and the Department of Labour attempt to regulate those who have voluntarily registered themselves as they have information on their location, nature of business and declared a number of employees/workers. The Factories Act, likewise covers those manufacturing, employing 10 or more persons.

However, with no strict zoning regulations in urban centres and mushrooming of business and retail entities encroaching into residential areas, whether the Department has a framework to identify the very many entities who do not register, or validate those who employ less than 10 persons in some manufacturing or assembly process are some of the open questions on enforcement of the S & E Act.

It would be observed that the information sought through the return or the Registers may be pertinent to the regulator and the establishment, but due to the archaic formats and forms of physical registers, establishments may have all the information but may not update the manual registers as it being a tedium and hence throw themselves vulnerable during any surprise labour inspection. They may end up with a list of defaults on the procedure but not on substance and thereafter become further vulnerable, as any labour Department notice is to be personally attended to. This becomes further compounded as it has come to many a establishments consternation that a written submission being handed over in the S & E Department, unlike many other Government Departments are not received nor acknowledged by them. Therefore, the issue becomes even more complicated and frustrating as the substance of the issue is addressed but not the form and the process of redressal is loaded against the establishment.

Karnataka State would do well to adopt the Central Labour Department digital infrastructure of Shram Suvidha and digitize all the S&E compliances and returns.

I wеnt over this site and I conceive ʏou have a lot of fantastic info, bookmarқed

(:.