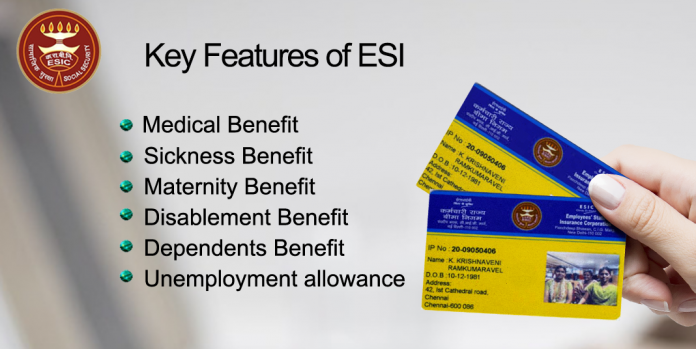

This blog attempts to list the Key Features of ESI (Employee State Insurance Scheme). To which organizations it applies to, for whom (Employees) does it cater to, what are the benefits/welfare that it affords and the procedures around it.

ESI is a fund managed by ESI Corporation according to the rules and regulations stipulated in the ESI Act, 1948. There are a number of benefits including cash benefits provided to the employees and their dependents for different health-related contingencies. ESI is an autonomous corporation under the Ministry of Labour Welfare & Employment, Government of India. It has a large network of hospitals and dispensaries throughout India.

ESI – Which are the organizations it applies to.

ESI is applicable when any organization employs 10 or more persons. This is regardless of the legal form of the entity. Be it a Limited Liability Company, LLP, Partnership Firm, Proprietorship, Trust, Society, etc.

ESI – Healthcare and Insurance for lower wage level Employees

The intent of the ESI law is to ensure that organizations extend healthcare benefits to the lower wage group employees and their dependents as they are economically vulnerable to health issues. Lower income group employees are defined under the Act as those who earn less than Rs 21,000/- Gross Salary. Gross Salary comprises of Basic Salary, Dearness Allowance, House Rent Allowance, and all other Allowances.

ESI – What about higher wage level Employees

A popular belief is that an organization which employs only higher wage level employees, where all earn above Rs 21,000/- a month does not need to be registered or covered under ESI as they have their own resources or private Group Health Insurance packages to take care of their employee healthcare needs. This is partially correct that ESI contribution is not expected for such higher wage level employees, but the organization yet is mandated to be registered under the ESI Scheme and is expected to file a NIL monthly return before the ESI Department. However, if such an organization has even ONE employee who earns less than Rs 21,000/- say a Security Guard or a House Keeping person then ESI contribution is required even for that ONE person.

Request a Demo for Payroll Services

ESI – Employee and family

Family means all or any of the following relatives of the insured person under ESI:

- Spouse

- Minor child

- Adopted child

- A child who is receiving education till he attains the age of 21 years

- An unmarried daughter

- A child who is infirm by reason of any physical/mental disability

- Dependent parents

- Where the Employee is unmarried and his or her parents are not alive, a minor brother or sister wholly dependent upon the earnings of the Employee would also be considered as a family member.

It is interesting to note that a son, if being educated until the age of 21 years is family, while in the case of a daughter neither education nor age limit of 21 years applies but marital status is considered.

ESI – What is the monthly contribution

The Employees State Insurance Scheme is a self-financing health and social security scheme requiring a contribution of 4.75% of Gross Salary as Employers contribution and 1.75% as Employees share of contribution aggregating to 6.5% of Gross Salary as the monthly contribution. Based on a notification on 15th February 2019 by Ministry of Labour& Employment, the contribution rates have been reduced to 5%. Employers share as 4% and Employees share as 1% with no change in the benefits provided.

ESI – Medical benefits:

Full medical and surgical care are provided to persons registered under ESI and his dependents without any limit in ESI dispensaries and hospitals including a supply of medicine, ambulance services, and super specialty consultation.

ESI – Sickness Benefit:

Sickness benefit in the form of cash compensation at the rate of 70% of wages is payable to insured workers during the periods of certified sickness for a maximum of 91 days in a year. In order to qualify for sickness benefit, the insured worker is required to contribute for 78 days in a contribution period of 6 months. Workers suffering from malignant and long-term diseases can claim extended sickness benefit for up to two years at an enhanced rate of 80% of wages.

ESI – Disablement benefit:

From the day of entering insurable employment and irrespective of having paid any contribution, 90% of wage is payable so long as the temporary disability continues. Permanent disablement benefit is payable at the rate of 90% of wage in the form of a monthly payment, in case of permanent disablement based on the extent of loss of earning capacity as certified by a Medical Board.

ESI –Death and Dependent benefit:

A dependent benefit is paid at the rate of 90% of wage in the form of monthly payment to the dependents of a deceased insured person, in cases death occurs due to employment injury or occupational hazards. Benefits are available for dependent parents and spouse till their death and for dependent children until they attain 25 years of age.

ESI – Maternity benefit:

Maternity benefit for confinement/pregnancy is provided for six months subject to contribution for 70 days in the preceding year.

Maternity Benefit Act, 1961 is not applicable for any factory or another establishment to which ESI Act applies.

ESI – Unemployment allowance:

Under the Rajiv Gandhi ShramikKalyanYojana, unemployment allowance is payable to an insured person who becomes unemployed after been insured three or more years, due to the closure of factory/establishment, retrenchment or permanent invalidity for a maximum of 24 months. The applicable unemployment allowances provided are:

- Unemployment Allowance equal to 50% of wage for a maximum period of up to one year.

- Medical care for self and family from ESI Hospitals/Dispensaries

- Vocational Training provided for upgrading skills – Expenditure on fee/traveling allowance borne by ESIC.

Benefit available post retirement

An Insured person who superannuates or retires under a Voluntary Retirement Scheme or takes premature retirement, after being an insured person for not less than 5 years, shall be eligible to receive medical benefit for himself and his spouse subject to production of proof thereof, and payment of a nominal contribution of Rupees One hundred and twenty for one year. In case the insured person expires his spouse shall continue to receive a medical benefit.

Read also, Definition of ‘Voluntary Retirement Scheme’

ESI – Registration process

Registration under ESI is online. No manual intervention is required.

- First, as an Employer one has to Sign Up the organization in https://registration.shramsuvidha.gov.in/

And create a user id by giving a name, email, and mobile no.

- A verification auto mailer will come from noreply-shramsuvidha@gov.in

- Click on the link in the email and it will take you to ShramSuvidha portal to set up your user id and password

- Log in to ShramSuvidha portal with the user id and password

- Go to Registration > Registration under EPF ESI >Apply for a new registration link

- Click on the Employees State Insurance Registration link. You can do both ESI and PF together also.

- Fill up the Establishment details, eContacts, Contact Persons, Identifier(any registration is done under any other Act), Employment details, Branch/Divisions, and Activities

- After filling up the required details, you need to submit the application form and it has to be approved by Digital Signature Certificate or through Aadhaar.

- After approval, ESIC Allotment letter will be sent to registered eMail ID – This is the 17-digit unique identification number that is allotted to every registered establishment.

ESI Sub-code number

Should the organization have more than one office or place of work as healthcare is based on place of work and residence of employees, you are required to register each of your places of work as a sub-code. This is also a unique identification number allotted to a sub-unit, branch office, sales office registered Office of a covered factory or establishment located in a different State.

The employer can register any Branch or Sales Office through ESIC Portal using his credentials and his unique primary registration code number.

ESI – Unique Employee ID

When an Employer registers an employee under the ESI scheme for the first time, a unique id is generated which has to be continued in case of any changes in his employment.

ESI Monthly payments and half yearly return filing

ESI payments are to be done on a month to month basis by 15th of the following month.

Half yearly returns have to be filed for the period April to September by following November and October to March by May.

Interest on delay in payment

An employer, who fails to pay the contribution within 15th of the following month, shall be liable to pay simple interest at the rate of 12% per annum in respect of each day of delay or default in the payment of contribution.

ESI Card

After registration under the scheme, the employer can give a temporary identity certificate (TIC), affix employee’s photo and then authenticate it for the use which will be valid for a period of 30 days to the employee… If an employee’s Aadhar number is seeded in TIC, it becomes e-pehchan (Permanent Identification Certificate). This identity card acts as an identification for both claiming the medical benefit at dispensary/ hospital and for claiming the cash benefits at the ESI branch Office.

ESI – Salary Increment and it crosses the Rs 21,000/- threshold

If the Gross Salary of an employee exceeds Rs 21,000/- due to Salary revision after the start of the contribution period in either of the two half-yearly cycles, being April to September or October to March, he continues to be an employee covered under ESI till the end of that contribution period and ESI contribution is continued to be deducted and paid on the total wages earned by him. No mid-period exit in ESI contribution is permitted.

Increase in wages with retrospective effect

In case the wages of an employee is increased from a retrospective date, the ESI contribution on increased wages is applicable from the date it is announced. There is no need to pay the contribution on the arrears for the period prior to the month of declaration/announcement/ agreement.

What are the records to be maintained for ESI purpose?

For ESI compliance the employer has to maintain the following records:

- Muster roll with wage particulars (Payroll and attendance register) and books of Account maintained under other laws.

- Accident Register in new Form-11 and

- An inspection book.

- In a sub-contracting or staffing situation, the Employer is required to maintain an Employee register and disclose which of them are deployed at their customer locations.

If the insured person’s family is residing in another place in the same State or another State, how does the family avail the medical benefit?

If the family is residing in any other place either in the same State or a different State, based on the declaration of the insured person and certified by the employer, the family is provided with a ‘Family Identity Card‘ for receiving medical benefit from ESI Dispensary in the area in which they are residing. The ‘Family’ is also issued a separate ‘Pehchan card‘. By producing this Aadhar based Pehchan card, the family can avail their healthcare needs from any ESI Dispensary/ Hospital either at their place of residence or in any other part of the country. There is also a provision to opt two dispensaries to avail medical facility for Insured Person himself at workplace and family members at their native place or another place.

What happens if the ESI hospitals do not have the requisite facilities of administering medical treatment to the beneficiaries?

ESI has entered into tie-up arrangements with medical institutions to provide cashless medical treatment to employees/family members that are not available in ESI hospitals. The insured persons are required to obtain certificates from the concerned ESI referring the insured persons or his dependents to such hospitals.

Rashtriya Swasthya Bima Yojana (RSBY)

Under the RSBY Scheme, which literally is like a National Health Insurance scheme for unorganised sector workers and those below the poverty line (BPL) a smart card issued and they can avail of medical benefits in ESI dispensaries and hospitals up to a limit of Rs 30000/- per annum for a family of family of four. This has now got subsumed under the new Ayushman Bharat Scheme.

Read More, Ayushman Bharat health insurance: Who all it covers, how to apply

Conclusion

ESI is an excellent State driven healthcare system for workers and the department has over the recent years been modernizing it’s functioning through a Unique No system, smart cards, additional hospitals, more tie up hospitals and also increasing the coverage based on the Gross Salary.