Broadly there are two frameworks of labour law enactments that cover organizations. One is The Karnataka Shops and Commercial Establishments Act (S&E), which is a State legislation administered under the Department of Labour. Second, is the Factories Act 1948, central legislation which covers all manufacturing entities that employ 10...

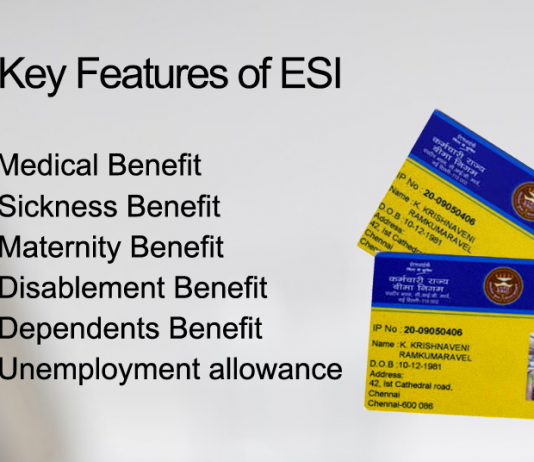

This blog attempts to list the Key Features of ESI (Employee State Insurance Scheme). To which organizations it applies to, for whom (Employees) does it cater to, what are the benefits/welfare that it affords and the procedures around it.

ESI is a fund managed by ESI Corporation according to the rules...

On February 28th, the Supreme Court passed a judgment settling many pending disputes between Employers and the EPFO attempting to address the question as to what is Salary for the purposes of computing PF contribution. It held that the contracted salary is the basis for PF with the exception...

The Provident Fund system in India has come a long way and has substantially been digitized but yet the general public perception is one of bureaucracy and having to live with no alternative, especially the Salaried class in the organized sector.

UAN

The Universal Account Number (UAN) was introduced on October...

This article brings out the key features of applicability and registration with the Employees Provident Fund Organisation (PF dept)

Brief Description:

Provident Fund is a Social Security Benefit to employees. During an employee's productive life he along with his employer contribute monthly to a PF Fund which then serves as a...

Introduction of SINGLE PAGE Composite PF Claim Forms instead of THREE Forms

EPFO has introduced a single page claim form with effect from February 20, 2017. This replaces the existing 3 Form i.e. Form 19, Form 10C and Form 31 for PF withdrawals and loans. It also eliminates Employer certification.

The...

An introduction of international worker provisions in PF

Foreign nationals coming to take employment in India were earlier excluded from the provisions of the EPF Act as their remunerations in most cases far exceeded above the statutory threshold limit.

On the other hand, Indian workers venturing to work overseas are subjected...

This article is to facilitate online payment of Provident fund remittances for those firms which are having SBI Corporate account.

First, visit EPFO site and generate monthly contribution challan, then follow it by making remittance in SBI online. The Process is detailed below.

EPFO site

Visit EPF website at https://www.epfindia.gov.in/site_en/index.php and click...

A stipend is a fixed periodic payment to a student as a scholarship or a fellowship allowance. The question of whether Provident Fund (PF) applies to such Stipend payment or not is one of the legitimacy of the payee being a registered student, a letter from the educational institution...

Provident Fund has been long considered as a long-term savings option for a good rate of return ( 2016-17 rate of 8.65%)and tax-exempt nature. The drawback was red tape in case of withdrawals, transfers, a settlement on retirement, etc. It is a cumbersome exercise of authentication, certification, attestation of...